Some Known Factual Statements About Clark Wealth Partners

Table of Contents4 Simple Techniques For Clark Wealth PartnersMore About Clark Wealth PartnersClark Wealth Partners Can Be Fun For AnyoneNot known Details About Clark Wealth Partners The Single Strategy To Use For Clark Wealth PartnersClark Wealth Partners for BeginnersClark Wealth Partners Things To Know Before You Get ThisUnknown Facts About Clark Wealth Partners

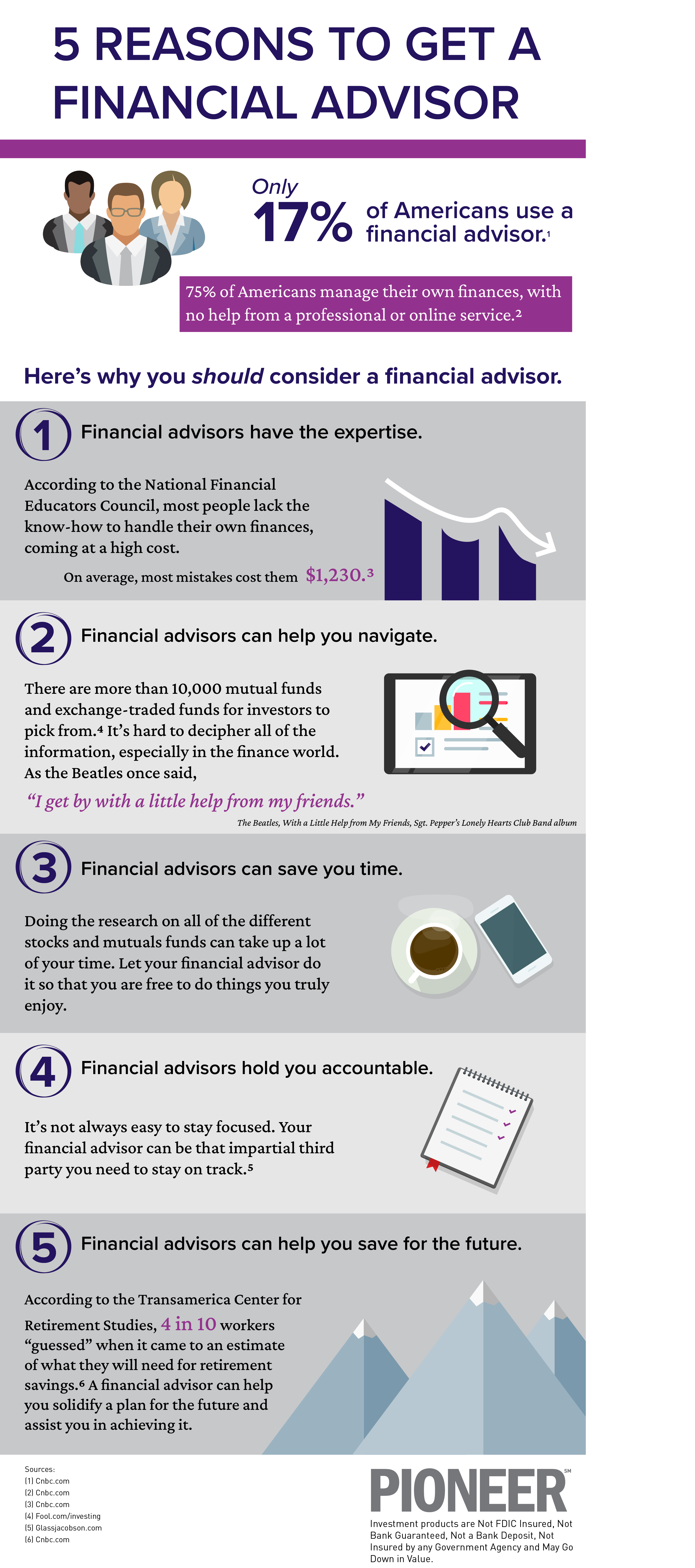

Typical factors to think about a monetary advisor are: If your financial situation has actually come to be much more intricate, or you lack self-confidence in your money-managing skills. Saving or navigating major life events like marital relationship, divorce, youngsters, inheritance, or task change that might significantly affect your financial situation. Navigating the change from saving for retired life to preserving riches throughout retirement and how to produce a strong retirement earnings plan.New modern technology has brought about even more extensive automated monetary tools, like robo-advisors. It's up to you to investigate and establish the appropriate fit - https://clrkwlthprtnr.start.page. Inevitably, a great monetary expert ought to be as mindful of your investments as they are with their very own, preventing excessive costs, saving cash on tax obligations, and being as transparent as feasible concerning your gains and losses

The 15-Second Trick For Clark Wealth Partners

Gaining a commission on item referrals does not always mean your fee-based advisor works versus your ideal interests. But they may be much more likely to advise services and products on which they earn a commission, which may or may not remain in your best interest. A fiduciary is legitimately bound to put their client's passions.

This typical allows them to make recommendations for financial investments and services as long as they match their client's objectives, danger tolerance, and financial scenario. On the various other hand, fiduciary advisors are legitimately obligated to act in their customer's finest interest rather than their very own.

The Ultimate Guide To Clark Wealth Partners

ExperienceTessa reported on all points spending deep-diving into intricate financial subjects, clarifying lesser-known investment avenues, and discovering ways readers can work the system to their benefit. As a personal financing expert in her 20s, Tessa is acutely familiar with the influences time and uncertainty have on your financial investment decisions.

It was a targeted advertisement, and it functioned. Find out more Review less.

Some Of Clark Wealth Partners

There's no single path to ending up being one, with some people starting in banking or insurance, while others begin in accounting. 1Most monetary coordinators begin with a bachelor's level in financing, economics, bookkeeping, organization, or a relevant topic. A four-year level provides a strong foundation for jobs in investments, budgeting, and client solutions.

How Clark Wealth Partners can Save You Time, Stress, and Money.

Typical examples consist of the FINRA Collection 7 and Collection 65 exams for safety and securities, or a state-issued insurance policy certificate for selling life or health insurance policy. While qualifications may not be lawfully required for all intending roles, employers and clients commonly view them as a standard of professionalism and reliability. We take a look at optional qualifications in the next area.

Many financial planners have 1-3 years of experience and familiarity with financial items, compliance criteria, and direct customer communication. A solid academic history is necessary, but experience shows the capacity to use theory in real-world settings. Some programs integrate both, enabling you to complete coursework while earning supervised hours through internships and practicums.

Clark Wealth Partners - The Facts

Numerous go into the field after operating in banking, accounting, or insurance, and the shift requires determination, networking, and usually advanced qualifications. Very early years can bring lengthy hours, pressure to build a client base, and the need to consistently prove your know-how. Still, the profession supplies strong lasting capacity. Financial coordinators appreciate the opportunity to function carefully with customers, guide important life choices, and frequently attain adaptability in timetables or self-employment.

Wide range supervisors can raise their revenues with commissions, possession costs, and efficiency benefits. Monetary supervisors oversee a group of financial coordinators and consultants, setting departmental method, managing compliance, budgeting, and directing inner operations. They spent less time on the client-facing side of the market. Nearly all economic managers hold a bachelor's degree, and numerous have an MBA or similar graduate degree.

8 Easy Facts About Clark Wealth Partners Shown

Optional qualifications, such see this site as the CFP, typically need added coursework and testing, which can extend the timeline by a number of years. According to the Bureau of Labor Statistics, individual economic consultants earn a median yearly annual salary of $102,140, with leading earners making over $239,000.

In various other districts, there are regulations that need them to meet specific demands to make use of the monetary consultant or economic organizer titles (st louis wealth management firms). What establishes some financial experts besides others are education, training, experience and certifications. There are many designations for financial consultants. For economic planners, there are 3 usual classifications: Qualified, Personal and Registered Financial Coordinator.

The Best Strategy To Use For Clark Wealth Partners

Those on income might have a reward to promote the services and products their employers use. Where to discover a monetary consultant will certainly depend upon the type of guidance you require. These establishments have staff that might aid you recognize and buy specific sorts of investments. As an example, term down payments, ensured investment certifications (GICs) and common funds.